Btl mortgage calculator how much can i borrow

Most BTL mortgages are interest-only. Please get in touch over the phone or visit us in branch.

How Much Will My Mortgage Cost Calculator

The monthly interest payments on a buy-to-let mortgage depend on various factors.

. There are many reasons you may want to give a cash gift to your loved ones. Though it can range from 20 to 40. How much can I borrow calculator.

A full Illustration is available on request or online. Find out how much you could borrow by selling a percentage of your property for a cash lump sum. Loan-to-Value Ratio Qualifications.

The narrowing cost benefit of two year compared to five-year fixed rates may incentivise. A Buy to Let mortgage is a loan secured against one of these properties. You can make a lot of money from becoming a landlord if you make smart.

An AIP is a personalised indication of how much you could borrow. Military personnel can borrow up to 50 percent of their salaries to buy their first home. The average one year fixed bond has reached a near 10-year high according to data from the latest Moneyfacts UK Savings Trends Treasury Report.

Loan to value LTV calculator. Call 0808 149 9177 or request a callback. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1.

However there are some important differences particularly when considering how much you can afford and the size of your deposit. It is not an offer of a mortgage. Most BTL loans are structured as interest-only.

How Much Can I Borrow. Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy. At 50 and 70 LTV the maximum loan amount available may be higher than displayed.

It could be to help pay for a wedding a new car or university fees or to help give the younger generation a leg-up onto the property ladderOthers want to gift cash to reduce the value of their estate for inheritance tax IHT purposes with cash gift tax often being far less than the 40. Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that. BTL Product Guide Specialist buy to let mortgages Foundation Home Loans is the home of specialist buy to let mortgages offering criteria to meet a wide range of specialist mortgage needs available to portfolio landlords individual landlords and those buying or remortgaging via Limited Companies.

Buy to let BTL mortgages are for landlords who want to buy property to rent it out. THIS SITE IS INTENDED FOR THE USE OF UK MORTGAGE INTERMEDIARIES AND PROFESSIONAL ADVISORS ONLY. A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit.

Speak to an award-winning mortgage broker today. This calculator shows the maximum amount available at the products LTV based on TMWs loan size restrictions. It will show you the mortgages including interest rates and product fees that are available and the total amount payable over your mortgage deal.

This percentage is interest-free and it is designed to go up to 25000. Your rental income will need to be above 125 of your monthly mortgage payment so if your mortgage is 1000 your rent will need to be at least 1250. Applying for a buy to let mortgage is a fairly similar process to a residential mortgage application.

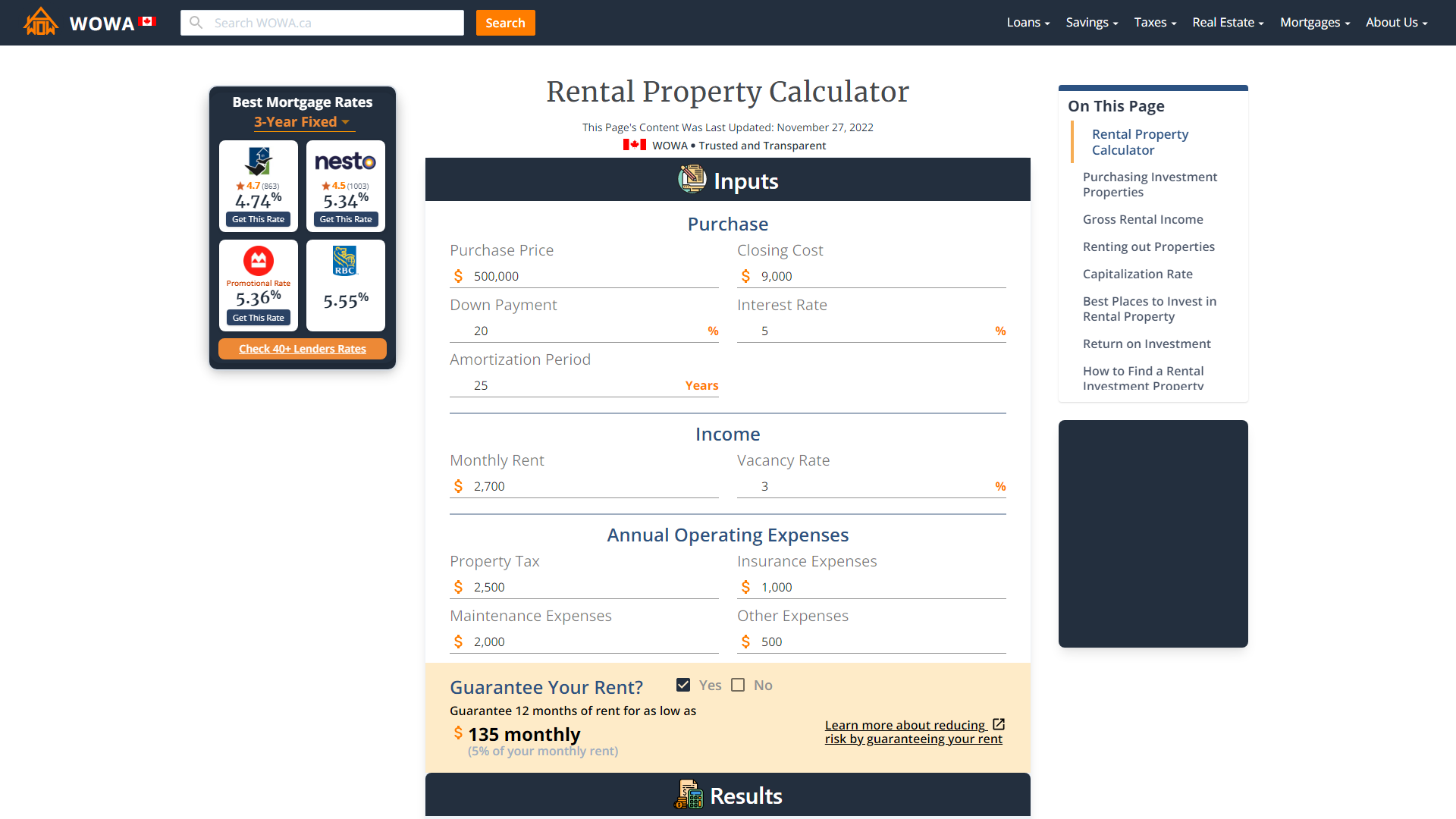

The loan-to-value LTV generally needs to be lower than 85. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Our buy to let mortgage calculator gives you essential information on interest rates LTV monthly payments how much you can borrow and more.

Our free buy to let calculator gives you quotes for BTL mortgage interest rates monthly repayments and rental yield estimations using basic information such as property value monthly rent and how. First simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years however more lenders are now happy to offer mortgages over periods of up to. The minimum deposit for a buy-to-let mortgage is usually 25 of the propertys value although it can vary between 20-40.

However over that same period the differential between two- and five-year average rates has shrunk from 030 to 015. Mortgage - Stores your mortgage settings for use across the website. Screen - Stores the screen size of the device that you are viewing our website on.

Ahloanamt - Stores your mortgage settings for use across the website to pre-populate mortgage calculators. In fact it is the first time this average rate has breached 2 AER since December 2012. It will not impact your credit score and takes less than 10 minutes.

Mortgage - Stores your mortgage settings for use across the website. Our calculator works out your loan-to-value LTV based upon your house price and how much you need to borrow. Mortgage Advice Bureau have 1600 UK advisers with 200 awards between them.

This calculator is for guidance purposes only. A remortgage calculator can help you to find and compare remortgage deals. Understand what they are and how much you can borrow.

What LTD company BTL mortgages are and more. Particularly the longer-term fixes which can be around 1 more expensive for buy-to-let versus residential equivalents. Loan to Value Calculator.

Call us free on. Here are things to consider with a buy to let mortgage. This means you pay the interest each month but not the capital amount.

Currently this figure stands at 229 AER and was last matched in November 2012. Recent - Stores information of the last pages you have viewed. In some instances eg.

Screen - Stores the screen size of the device that you are viewing our website on. Ahloanamt - Stores your mortgage settings for use across the website to pre-populate mortgage calculators. Like any form of investment theres a lot to consider before you make the jump as.

Generally a BTL mortgage will be more expensive than the equivalent residential mortgage. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you. The Central Banks mortgage lending rules state that a prospective home buyer can borrow up to 35 times their annual income though in some cases banks can provide an exemption to this limit and loan you more.

All RIO mortgage quotes can be tailored to your own circumstances and you are under no obligation to proceed. The overall five-year fixed average has gone up by 016 since the first of this month to 424 a rise of 160 compared to last December. What is a Buy to Let mortgage.

At the end of the mortgage term you repay the original loan in full. Use our mortgage calculator to compare interest rates and cashback offers from lenders nationwide. These include the size of your initial loan the rental value of your property and your own financial situationHowever it will also heavily depend on what type of loan you take out be it a fixed rate or variable rate mortgage.

Right to Buy Calculator. There are advantages and disadvantages to all types of. All applications are subject to lending policy and product availability.

Recent - Stores information of the last pages you have viewed.

Investment Mortgage Calculator

Vx7pf14s1xw2um

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

:max_bytes(150000):strip_icc()/housecalculator-56a7dc723df78cf7729a0745.jpg)

Mortgage Calculator

Mortgage Calculator Centre Mortgages Bank Of Ireland

French Mortgage Calculator Frenchentree

Free Interest Only Loan Calculator For Excel

Vx7pf14s1xw2um

Your Ultimate Spanish Mortgage Calculator What Is The Cost Of Your Spanish Mortgage How To Buy In Spain

Let To Buy Calculator

Mortgage Pre Approval What Are The Advantages Buy To Let Mortgage Preapproved Mortgage Mortgage

Try One Of Our Mortgage Calculators Haysto

Lzbw6a1vckffem

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

British Columbia Bc Mortgage Calculator Best Rate 4 54

Buy To Let Mortgages Natwest International

How Much Is A Down Payment On A House Do You Need 20 Percent Thestreet